After the abolition of the gold standard, various means of hedging against currency risks were extensively used worldwide, the most reliable of which was recognized a currency basket. This is generally a set of currencies of several countries for regulating the rate of the base currency, or to create special units of account.

This tool is widely used by individual states in the development of national monetary policy, as well as by international organizations, businesses and citizens for profit and capital protection from currency fluctuations.

In its composition, the basket may be multi-currency or dual-currency. In practice, the first option is more common, because it allows the parties taking into account a number of risks, both their own and those of their trading partners. This approach also opens up opportunities for earnings and hedging to speculators and investors.

Currency basket as a mechanism of monetary policy

At the international level, the best-known example of the practical implementation of such a mechanism is special drawing rights (hereinafter SDR), created and issued by the IMF since 1969. For its intended purpose it is a payment instrument that used exclusively within the IMF to regulate the balance of payments of member countries, replenish reserves and settle on loans granted by the Monetary Fund.

In fact, the DSS is a weighted average of the rates of US dollar, euro, Japanese yen and the pound sterling. Only the dollar value of the components is taken into account, and for each of them a weighting factor is set, which is regularly reviewed.

Another example is a special and universal European Currency Unit (ECU), which has all the features characteristic of a currency basket and has been used in countries of the European Union in non-cash transactions and for the regulation of the parities of national currencies to the creation of the Common European Currency. In this case, the euro can’t be considered the same tool, because the currency basket is created in the form of a portfolio of several currencies and can’t be used in consumer settlements.

Some states have their own approaches to the regulation of rates and risk protection, but the most striking example is the “dual-currency basket” of the Bank of Russia, which allows tracking the dynamics of ruble against the dollar and the euro not individually, but in the aggregate, at the same time assigning each component its own weight. Such monitoring allows the monetary authorities to make timely decisions on adjustments.

How the currency basket is different from currency index

The use of the currency basket is similar to portfolio investment (purchase of several tools in order to reduce individual risk), but as the general public is unaware of the details of the algorithms used by corporations in their operations, there is a wide field for creativity for independent traders in this field, but at the same time there is a lot of confusion and outright nonsense.

First of all, you must remember that the currency basket and the currency index are two different methods of analysis and trading, albeit very similar. The matter is that the basket can consist from a completely different currency pairs, and the link to the resulting set to a specific base currency is not a prerequisite.

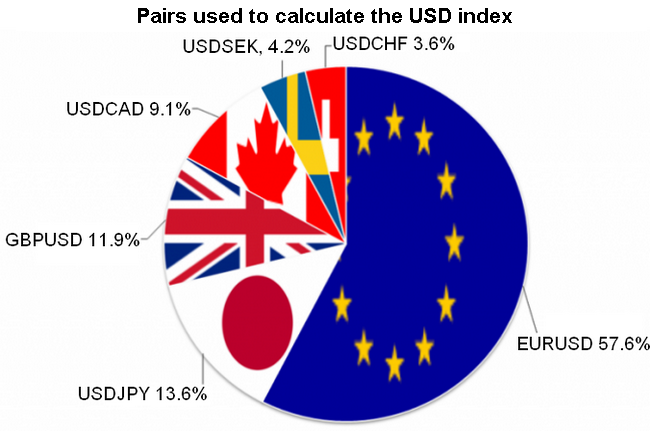

The reverse situation is characteristic for the indexes, which are designed to identify the general trend in a particular currency. For example, the dollar index is the ratio of the value of the dollar to a basket of major currencies, i.e. purchase index will be equivalent to the opening of long positions in pairs where the dollar is represented as the base currency, and the simultaneous sale of instruments where the dollar is the quote currency.

Therefore, it is incorrect to talk about trading a basket in this case. The opposite operation is a different thing, because the sale of the dollar index will be equivalent to the buying a currency basket, which rates are included in the index. But this is just a special case, on the basis of which it is unacceptable to equate such approaches.

Trading strategy involving buying a basket of currencies

Currency basket provides more opportunities than it might seem at first glance. Below we’ll review a reliable long-term strategy, which in various modifications can be applied to many currency pairs – it is trading a basket of resource-producing countries.

It's no secret that the countries, whose main export is raw materials, are characterized by a strong correlation between the rate of the national currency and a profile commodity price in world markets, so that the latter is a kind of a guide for the money market, i.e. the reversal of the trend in the commodity market is preceded by a change of trend in the currency.

However, if we consider such a correlation for each country separately, there is a high probability of noise and distortion as a result of regional risks – political, natural, war, difficult economic situation, etc. The need to set up a currency basket arises for elimination of such situations.

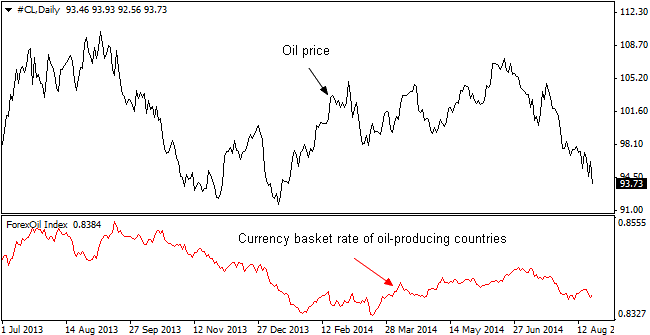

For a better understanding of the situation, let’s consider the example of oil-producing countries. First of all, you need to create a special indicator to build a chart of the basket rate – let’s call it ForexOil (hereinafter FO). All it takes is to modify the standard indicators to calculate currency indices by means of MetaEditor.

The most interesting challenge requires the solution in the next stage – the choice of currencies for FO and the calculation of the relevant coefficients averaging. In the current example, the Mexican peso, the Nigerian naira, the Canadian dollar, the Russian ruble and the Norwegian krone were included in the formula. Technical capabilities allowed also including UAE dirham, but given the stability of the rate of this currency, the decision seemed impractical.

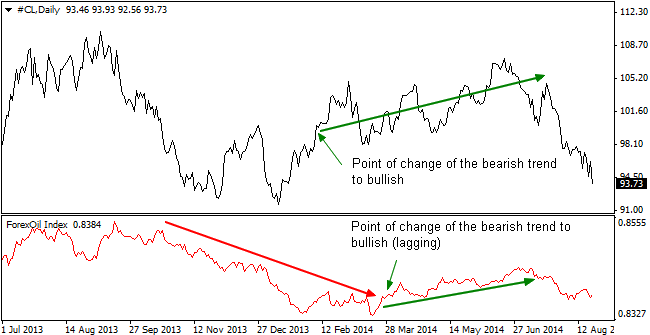

The figure above shows the charts of the oil and FO prices. Talking about the ratios, in this case only the cost of the currency against the dollar was taken into account when selecting them, i.e. the lower the rate, the larger the ratio has been assigned to make the effect more noticeable. Let’s note that for a more objective picture it is also recommended to add a link to the volume of production of “black gold” via an additional factor.

As you can see, the currency market is unfolding after the oil with a lag, so after oil prices have changed the trend, you should prepare for the simultaneous opening of positions on all currency pairs included in the basket, and you are advised to trade only in a bullish market.

You can also add some complexity to the system – for example, buy only those currencies that are significantly deviated from the general rate of FO downward, but it is a separate topic, which requires additional complex calculations. In addition, oil is only one option, and all sorts of associations and groups can be considered as an alternative, the main thing is to keep the logic of “total specialization”.

Social button for Joomla