Glossary

Glossary is much-needed information for beginners. The section contains explanation of key terms such as currency swaps and basket, leverage, hedging of risks and currency correlation. The section covers the features of building the currency charts, rules of choosing currency pairs, the method of wave analysis and more.

- Details

- Written by Admin

- Category: Glossary

- Hits: 7274

After the abolition of the gold standard, various means of hedging against currency risks were extensively used worldwide, the most reliable of which was recognized a currency basket. This is generally a set of currencies of several countries for regulating the rate of the base currency, or to create special units of account.

This tool is widely used by individual states in the development of national monetary policy, as well as by international organizations, businesses and citizens for profit and capital protection from currency fluctuations.

- Details

- Written by Admin

- Category: Glossary

- Hits: 7096

The role of any trading terminal is to provide a high degree of convenience for trading. Each trading terminal has all necessary settings and tools for complete “customization” or “adjustment”. So, there are plenty of options in any trading software to allow adjusting the visual display of the entire process of online trading. One of such points in the settings is a choice of visual display of the price chart. It is primarily a line graph in the form of a simple mathematical line, display of the prices in the form of the famous "candlesticks" and display of the chart in the form of bars. We’ll review the former type of graphical display of the prices.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6569

Forex bar is an element of the graph with the help of which the lower and the upper price indicators shown for a specific period of time. Such indicator is very similar to Japanese candles in its structure. Forex bar allows getting the following information: minimal and maximal price ranges that are functioning at a certain time span, the opening and closing prices of the given spaces. The opening and closing price are reflected on the graph with the help of short lines that are situated horizontally.

Forex bar is often used by traders for building different strategies. It is one of the main indicators, because it allows getting objective data about the price movement. The forex bar indicator can reflect different time frames, for example, a minute, an hour and even a day. Such details allows getting secure data about current price fluctuations in currency price for a certain moment in time, and thus allows determining more quickly the trend that exists on the market. Forex bar is used actively by the majority of traders, that is why its study is of great importance on seminars and courses.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6242

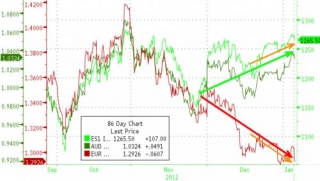

Forex graphs are the essential part of any trading strategy, because they allow watching the changes in the price of specific currencies. The graphs of forex quotations provide traders with information on price fluctuations during a long period (up to two months) and allow them predict future events. Forex graphs are fundamental for any prediction on currency market.

Forex online graphs are the great opportunity for a trader to obtain latest news on the situation on the market. With their help players can make successful deals because in that case they rely on specific data and not on their proper intuition. Forex graph analysis allows creating a correct strategy the usage of which can bring great profits in the future. The application of this information which is provided by Forex graphs in real time in trading allows approaching reasonably to every deal, relying on objective reasons for its opening or closure. Currently players can use different graphs of Forex currency which are based on different currencies and used indicators.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6025

Currency pairs – are the most essential tools of trading which allows getting profits due to difference in price among chosen currencies. The possibility of getting profits or losses will fully depend on how well you know the predictions of currency pairs. When choosing this tool for work, firstly it is essential to pay attention to:

- Volatility or dynamism – the higher it is the higher the chances are of getting good profits. But one should consider the circumstance of the risk of merging the deposit being higher, if the trader made a wrong deal.

- Liquidity determines the demand and offer for specific currency pairs.

- Predictability – the availability of information on specific currency tool is determined. The prediction of currency pairs is the definition of their reaction on specific events that occurred in the world and usage of this information in the strategy of the trader.

Currency pairs are divided into main which have dollar (for example, currency pair eur usd) and cross-currency that do not include American money (for example eur chf).

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6145

Currency pairs correlation – is a dependence of two financial tools which means currency pairs from each other. Its usage allows the players developing more precisely their trading strategies so that they can get more profits.

Currency correlation is expressed in a certain coefficient, the meaning of which can fluctuate from minus of the one to the plus of the other. Let’s look at the main meanings:

- minus coefficient means that the price of these currency pairs is always moving in different directions;

- plus one coefficient – the price of the currencies always moves equally, which means that if one trend grows, the second one will be growing too and vice versa;

- coefficient that equals zero means that these currency pairs are not mutually connected, that is why the direction of one trend will not influence the other one.

A trader should watch the fluctuations of the coefficient regularly. Currency correlation can be calculated either by the player himself, or by specialists of dealing centers, that later put the knowledge acquired on their websites. The table of currency pairs correlation is open for all internet users and not only for the traders collaborating with a specific broker, that is why anyone who wants it can get it if he needs it.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6170

Risks hedging is the protection of the assets from fluctuations of currency courses with making deals with fixed price on Forex market. Such procedure allows the trader to get the guaranteed profits which will be higher than all the charges to open positions. Using this strategy requires the player to invest a lot of money, more than a regular trading because it supposes opening several deals that compensate each other if needed.

Risks hedging as any other trading transaction on currency market requires the trader to analyze thoroughly the market. After the trend direction is determined the player opens the main deal from which he will get profits. In case the direction of price movement has changed a trader has to open two others based on the movement of the trend without closing first positions. One deal will bring profits to the trader and the second one will compensate the losses. One should close hedging deals only after the player is 100 % sure in the correctness of determining the trend and he can cover all the charges with profits gained.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 5872

Trend line is a straight line connecting two important price indicators on the graph. Forex analytics can take either minimal or maximal prices that will determine its direction at a given period of time. Currently there is no single opinion concerning that tool of technical analysis, since the lines of forex trend are built and explained by all the participants of the market in a different way.

Any forex strategy on trend lines must take into account the following indicators:

- Time – is the indicator that determines the behavior of the majority of market participants at a given interval. The longer the time span, the more reliable the line is.

- The angle of elevation determines the emotional state of players that are on the stock exchange at a certain period of time. If the line is gently sloping then the trend will be longer since the traders are inactive. In case the trend is abruptly ascending or descending, the situation is opposite since the dynamic players can change the prices.

- The deals volume demonstrate the moods of the market participants. One of the most important indicators of the change of the trend is exponentially growing number of participants and the volume of transactions made.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6798

If you are interested in what Forex swap is, then this article will help not only the beginner to understand this term but it will aid a professional to find out more new and interesting things. In fact currency swap stands for two different currency transactions, purchase and sale with different dates of valuation of currencies, and one of the transactions has to be forex swap date.

Currency swap is one of the most popular tools on forex currency exchange market. Portion of the swap deals is higher than the rotation of “outright” forwards. Despite the fact that forex swap in its shape reminds conversion deals, they belong to money-market transactions.

Forex swap is often made between the same broker companies and banks. Such swap type in economic world is called “clean”. In case big companies are accepted into the deals and there is a cooperation among them, then such trading transactions are called structured. However, such type of trading is not inherent in forex market and it is hard to come by.

For more clearness let’s look at an elementary example. A bank buys 1 000 000 $ against yen on the spot and sells these dollars under the condition of 2 monthly forwards. In this case the transaction will be called 2- month swap US dollars to yen.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6557

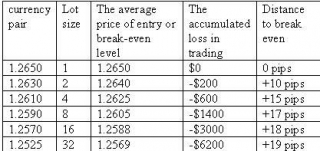

One can trade on Forex only in case he has a determined strategy, and there are many strategies. One of these strategies is Forex Martingale. In order to understand it, let’s look more closely at this strategy using the example of roulette at the casino. Thanks to it you will understand what the essence of Forex Martingale strategy is in.

As you know you can stake at the casino using two methods: the first is picking a certain number, the second type of the bet is to choose a variation, for example black/red, even/odd. The second type presupposes the possibility of winning with principle of 50 x 50. But if you decide to use this principle as it is, it can lead to ruins. So what is the basic principle of trading with the help of Martingale?

Forex Martingale as well as the roulette has to open and make deals constantly, until one of them does not lead to long-awaited profits. If you stake on roulette black and it turns out to be red, you need to raise the stakes and stake on black again. And every next win will cover previous losses.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 5928

Candlestick analysis – is an effective and interesting method of trading on Forex market. One will need to learn to analyze the combination of Japanese candlesticks in order to be able to build candlestick graphs. The shapes of candlestick analysis can be different, there is no need to learn all of them, you will need to know only the most helpful ones.

If you can build bar graphics then it will not be difficult for you to study forex candlestick analysis. You will need to work during the day because this method works best on daily graphs. Psychologically forex candlestick analysis leans on the closing and opening price of one day. Sometimes this dependence can change on the closing price of order of one day and opening price of the following day.

Forex candlestick analysis is different from the bar one only by its forms. In the interval between the opening price and order closing there is a figure in the shape of white or black rectangle which is called “candlestick body”. There are lines that are going down and up from the body – “shadows” that show the highest and lowest price in the time span. Depending on how far the orders of opening and closing are situated from each other, the color of the candlestick will change. The white color – if the closing price is higher than the price of opening, the black color otherwise.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6601

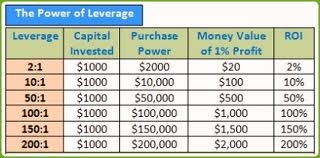

If you plan to earn money on Forex, you have to learn basic principles. The leverage is exactly one of those basic principles. So what is leverage? There is a strict definition of this term which states that leverage is the ratio of trading currency volume to overall funds that belong to the trader. Trader on Forex market is a dealer that carries out speculative trading.

To understand more easily how the leverage functions, let’s break up a simple example. You will need to face a ratio of 1:100. Which means that you will have 1000 rubles on your account, but you can make deals with 100 000 rubles. One should remember that when opening a deal he takes a margin (a deposit sum). To find out how to calculate the leverage let’s take 1000 rubles and leverage of 1:100. As a result it will be possible to open lots with the size of 0,02 and the price for one point will be equal to 5,65 rubles.

That is why Forex leverage is connected with the volume of deals made by you. A trader will have to choose a leverage that best suits his work and he will need to decide what overhead meaning he will determine for it. Often even leverage that has been chose correctly can guarantee profits or full loss of the deposit.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 5832

Trend indicators are the instruments of technical analysis which allow a trader to get the necessary information about a possible price change beforehand, and he can make decisions about opening or closing the deals accordingly, and the decision will be directed at getting maximal profits and minimal losses.

The trend indicators of Forex facilitate the work of players of currency exchange, because with their help traders can plan their actions and develop strategies that will bring great profits. The trend indicators of Forex are aimed at determining price fluctuations in the past and in the present, but they can’t predict the future with 100 % certainty. Based on the data obtained a trader makes assumptions about the price fluctuations, remembering about the fact that the currency value directs the indicator and not vice versa.

Thus trend indicators help determine the trend, no matter what period is of interest for the player. Now you know what indicators of technical analysis are, that’s why we can pass to a more detailed examination of the most popular kinds.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6604

Forex wave analysis is one of the most popular method of predicting the situation on the market among traders. It was created by sixty-year old accountant Ralph Nelson Elliot, who started searching for additional source of income due to health problems and he began learning the objective laws of the development of stock market.

Forex wave analysis is based on the notion that any movement of the price is made within a certain wave. Determining these waves helps in predicting market situation that is why while using this method, traders will be able to gain great profits from deals completed. Forex wave analysis makes exchange market’s players’ job easier and that is the main reason of success.

According to data which were provided by wave analysis of Forex market it is possible to determine the movement of prices but it should be done with caution. Such situation is explained by the fact that wave analysis of Forex market is demonstrating the trends of preceding periods in details. While building the wave for perspective often requires using additional methods, for example Fibonacci levels. Nevertheless using this wave analysis will allow a trader-beginner becoming a professional in his field and getting great profits.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 5923

Forex Order is a trader’s team informing a broker about the necessity to make the transaction, which means to buy or to sell certain papers or currency. One of the obligatory conditions that should be observed by every trader who is willing to open Forex Order is summation of the price of opening and spread, predetermined by a broker for this currency pair. Besides one should not forget about swap provided that you are planning to open the transaction for not less than for twenty-four hours. Smart calculation of all the positions stated will allow building the strategy of the trading correctly, and it will start bringing profits to its creator.

Forex Order has unlimited operating time it will exist until it is employed or cancelled. This is the reason a trader needs careful approach to taking orders, he should wait for the confirmation of this action from dealing center.

Now you know approximately what Forex Order is, so let’s pass to more precise study of it.Now we will tell you what kinds of orders for forex exist nowadays.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 5911

Today “forex currency” notion can be heard a lot. Almost everyone has heard at least once such words as: “forex currency rates”, someone has come across Forex advertisement on the internet or in real life. Someone pays attention from time to time to quotations of currency on Forex market, while others prefer not to argue and are already trying to trade on currency market, using not only demo account, but the real one.

Forex currency is of great importance for forming contemporary economy of absolutely all countries. Certainly such market is not quite clear at first for the beginners, and forex currency seems to be even more puzzling. The structure and functioning of the market is not clear either. So what is a trade on currency market? It is various operations of currency exchange via internet.

The essence of currency trader , or else a person making deals in this fashion) profession consists in the following:

- The ability to conduct a correct analysis of the situation on the market;

- The ability to evaluate correctly the present-day currency value on Forex;

- The skills of extremely accurate prediction of rate of exchange of currencies in the future.

Then based on the data obtained a trader buys currency for one price and sells for another. Or vice versa – sells currency pair for the highest price and buys when it lowers significantly. Is the prediction of forex currency is correct a trader gets the difference from the deal, which is the profit.

- Details

- Written by Jeremy Stanley

- Category: Glossary

- Hits: 6110

Any beginner on Forex market is interested in marginal trading and in how to get the most out of it. First of all it is necessary to understand that money do not fall from the sky and in order to gain profits is necessary to work really hard. Мargincall or marginal trading will bring profits only after you learn to analyze correctly financial and economic situation in the whole world and after you read a great amount of information about Forex market and of course get your first probably not the best experience. It is also essential to remember that there are various terms on forex market which one is recommended to know.

First of all one should understand what the term “marginal trade” means. Margin is a deposit that is found on your broker’s account, but in order to begin trading on the market, it is necessary to have a credit shoulder, which is a number that is multiplies by the margin. You are the trader and the broker is a person that stakes on your behalf, he is the irreplaceable mediator. Many experts on currency market think that it is the broker that is the key figure in margincall.