The successful dealer always knows not only how, but also what, when, to whom on the most beneficial price to sell it. The challenging and correctly chosen goods for the transaction − is an additional insurance of success. Let's try to describe several problems which the trader faces in the case of the choice of a Forex trade asset.

As if fans of a technical analysis didn't object, today traders pros spend 70% of trade time for the fundamental analysis of a market situation, and only 30% for the choice of point of entry and maintenance of a position. In particular, this popular asset control technique which is called «global macro» is used by large hedge funds, and serious fundamental information and global rates on the economy of one country against another are unavailable to the small trader. It is necessary to adapt to the limited resources.

If to consider that the technical analysis is equally available to everyone, and it is difficult to compete with the help of its methods, then the correct choice of a Forex trade asset is sometimes more important than transaction parameters. The assets, which are profitable at first sight, constantly attract beginners with fast earnings, but a misunderstanding of features of such trade will also quickly throw out you of the market.

Basic rules of estimation

The traditional arguments for the choice of a Forex trade asset are:

- volatility (size and time chart);

- correlation with other assets − dependence on the adjacent markets;

- liquidity;

- availability and reliability of fundamental data;

- technical parameters of the transaction (spreads, swaps, commissions and so forth);

- the complexity

- availability of the analysis of exchange amounts.

Volatility estimation is usually made by freely available online services. In practice allocate volatility:

- productive (or trend);

- speculative (with a zero trend, that is, as a result, the direction of the market doesn't change);

- long and short-term;

- technical and fundamental.

Believe to understand the chosen Forex trade asset, you should carefully study these data on the period at least for several years, and especially detailed − for last year.

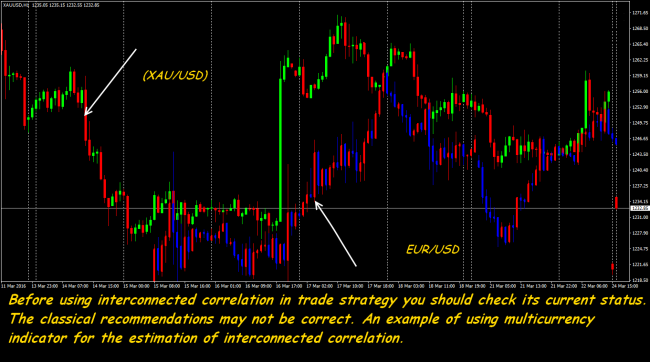

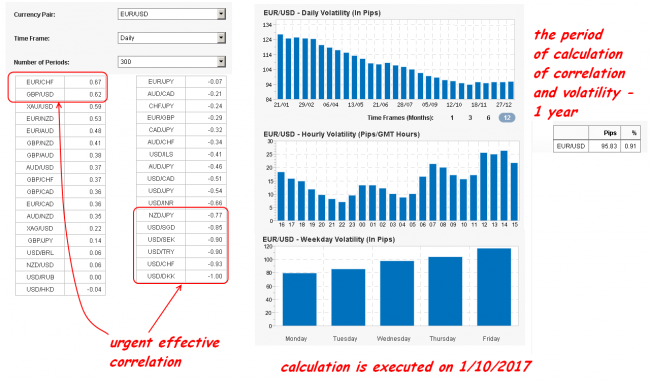

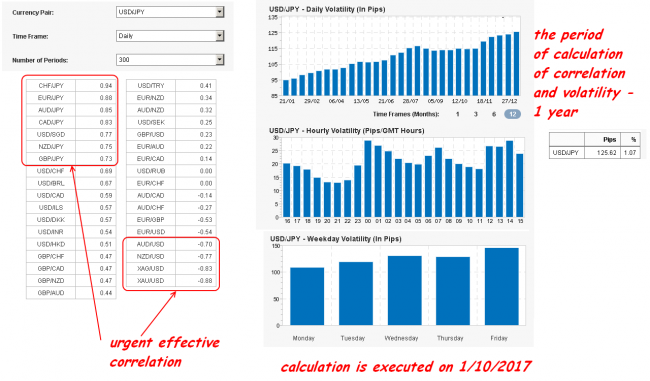

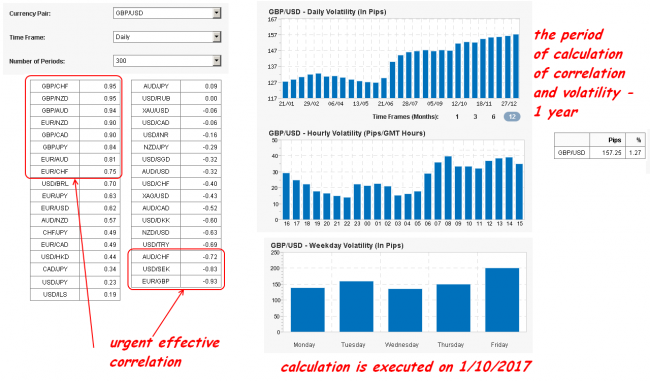

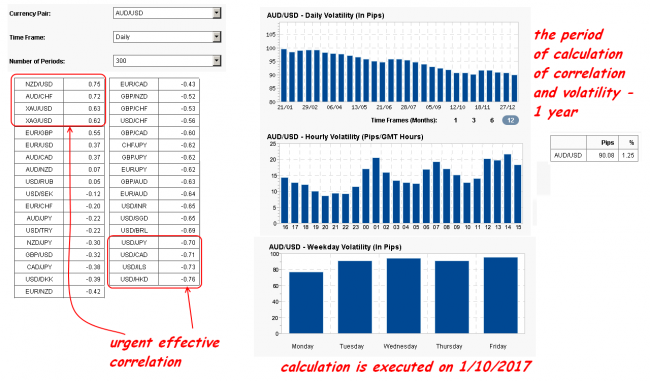

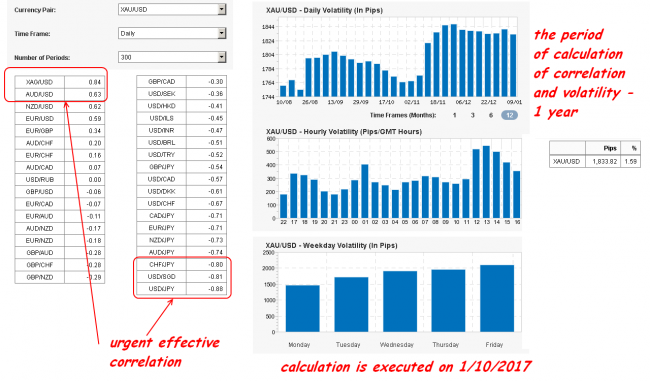

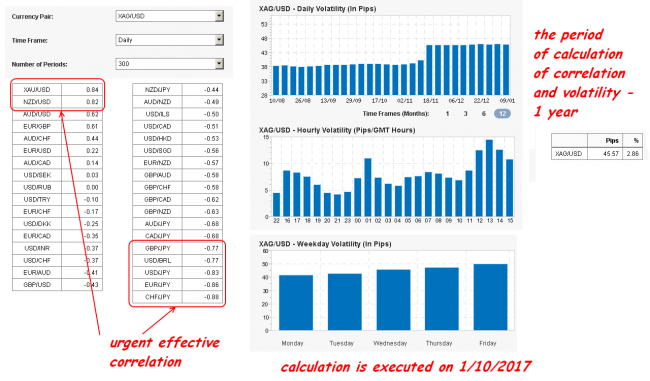

Correlation estimation with the adjacent markets and other assets is obligatory. Don't believe what is written in traditional recommendations or impose various «Forex guru» – intermarket communications constantly change. If you are going to trade on correlation − independently check an interconnection of assets at least once in a month using special services.

As a result, you have such view, for instance, on EUR/USD:

Or on the main Asian asset:

The analysis of amounts is extremely important for any assets, especially raw material, for this reason on such tools as oil or metals will be effective trade strategy on VSA patterns. They will help to see actions of large players or accumulating of amounts at the expense of fundamental factors in time.

Currency assets

Everyone tried to trade in currencies. The classification of Forex currency trade assets on the daily trading volumes (for example, G10 currencies) is the most widely used (but for today (quite misleading!) method. It is the approach of investment banks and brokers, and it is considered that it is convenient for perception by clients, but professional traders group currencies otherwise. Today on Forex you may trade any assets and classification by a regional sign is used generally for the collection of statistics − it doesn't influence trade. The small trader trades volatility, but not global economic signs.

They allocate the following groups of the currencies structured in the volume of their potential volatility:

- currencies of the countries with a free exchange rate formation mechanism with the diversified economy (Ex Commodity Floating);

- currencies of the countries with the fixed exchange rate with the diversified economy (Ex Commodity Pegged);

- raw currencies of the countries with a free exchange rate formation mechanism (Commodity Floating);

- raw currencies of the countries with the fixed exchange rate (Commodity Pegged).

Forex raw currencies (commodity currencies) which have a high degree of dependence on one or several primary goods that potentially increases their volatility, can be the most interesting trade assets.

Currencies with strictly regulated pricing are most difficult estimated:

- Denmark (the unique European economy from this group) – Danish krone is strictly tied to euro.

- Hong Kong (HKD) and Singapore dollar (SGD) − non-raw material Asian currencies with the fixed exchange rate.

- The Chinese yuan (CNH) − raw currency with a tough rate outside the region of the countries of GCC.

- Singapore (SGD) and Kuwaiti dinar (KWD) − currencies with the fixed exchange rate which don't open the data about binding currency.

The small player shall understand that his possibilities of trade in any exotic are very limited, unlike, for instance, Central Banks or large funds. It is considered that the most profitable assets – in a pair with US dollar, as 85% of all daily trading volume are the share of them. The highest liquidity provides small spread and high speed of handling of orders.

In addition to the European and Asian currencies which are holding leadership and almost not having negative side effect for the trade, let`s tell separately about currency cross-pairs.

Cross-pairs

All strategy of trade in cross-pairs are constructed on the use of their high volatility, therefore, they are so popular with scalpers. And today as the most high-volatile cross-rates are: AUD/CAD, AUD/NZD, AUD/JPY, CAD/JPY, GBP/JPY, EUR/JPY, GBP/CHF, EUR/AUD, CHF/JPY, NZD/JPY, EUR/CAD.

Each cross-asset is almost unique, it should be studied and tested, you should understand carefully dependence on the news to each economy separately. It is necessary to get used to the time schedule of volatility − it can be non-standard on cross-pair. Stops on crosses shall be bigger, than in the case of trade in the same strategy on the main pairs.

Movements of yen crosses traditionally advance movement of the main pairs of currencies. To those who prefer classical EUR/USD, it is recommended to watch closely for EUR/JPY movement: if the numerous tests or breakthrough of considerable technological levels is visible (especially on H4 above) on its graphics, then with the delay in 3-4 bars it is worth waiting for EUR/USD turn. Yen crosses rather well maintain a week trend, but equally well can lie for weeks in a flat. There is even a separate type of the strategy which are adjusted on trade in yen crosses.

Dozens of beginners make a huge mistake, preferring in the case of the choice of a Forex trade asset quieter to euro European currency, the second for the importance, which should be discussed separately.

English pound

Despite belonging to the European group, this asset «lives life» and after Brexit this divergence with basic pairs will only increase. Not for nothing the pound got the nickname «wild dog» because of the unpredictable volatility. For instance, the news negative across Great Britain causes strong throws on GBP/USD and GBP/JPY, but isn't reflected in EUR/USD or EUR/JPY in any way, and on EUR/GBP can just draw «tail» in 150-200 points and return to a initial value. GBP/JPY still is considered the most volatile cross-pair − to several hundred points a day.

Pound badly (and now − especially!) gives in to the standard analysis, requires special trade logic and a serious money management. It`s quite difficult to count reaction to the English fundamental factors and even standard statistics. Influence of political factors on the EUR and GBP dynamics led to the fact that their mutual correlation for last year is almost equal to zero, but so far Great Britain (actually!) still the member of the EU, dynamics of historically popular cross EUR/GBP quite submits to technical rules.

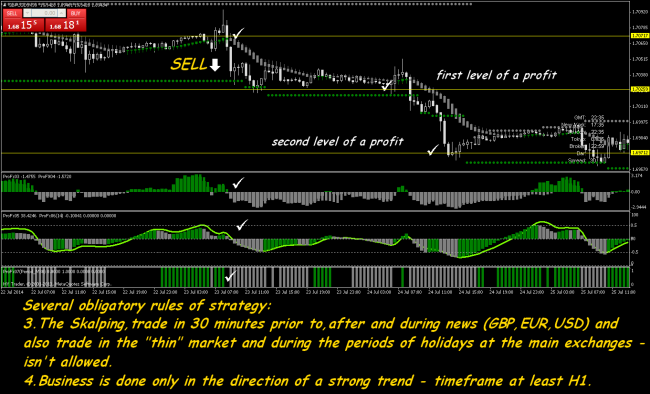

Recommendations concerning strategy. In general, technical approaches to trade by the pound are standard, but the scalping on it is quite dangerous. Medium-term trend strategy works normally, but with the increased stops. Sometimes the pound shows such «informal» behavior that some of his fans develop trade strategies, specially adapted for GBP/USD (the example provided below can be found in the network under the name «The Englishman in Grey»). Timeframe: for the trade − M30, for the search of a point of entry – M15.

In such techniques specially developed indicators give correct signals on pound practically in any market. Points of entry are visible on simultaneous change by indicators and crossing of the average line in additional windows.

By this technique the stop is obligatory put at the last strong level of support/resistance, and at least 30 and no more than 70 points. An exit out of the transaction is developed in case of achievement of a profit in 100 points, change of the direction on indicators or before an exit of news. The open transactions aren't left for the night.

The work on pound assets isn't recommended to beginners, especially in a current political situation, but even now GBP/JPY pair is the most technical in the market.

Australian dollar

Forex raw trade asset which is most recommended for beginners and small deposits. The reaction to the own base is rather predicted, it reacts to the American factors synchronously with the euro. The Central Bank behaves adequately (it doesn't use interventions) and practically doesn't interfere with regulation. The rate strongly depends on the Chinese statistics (especially − negative) and the dynamics of the influencing raw assets (gold, iron ore, energy carriers) on the stock exchanges.

Recommendations concerning the strategy. Perfectly takea technical analysis, stable, only technical trade strategy for an Aussie may be built on regular Ishimoku. It is most active in Asian, but keeps rather high volatility during the European session. Reacts to any universal force majeurs with some delay, therefore, Aussie is actively used for news trade. Fans of extreme can try to trade crosses EUR/AUD or GBP/AUD on a strong trend, but only on the periods not below H1 and with a tough money management.

Oil

Oil as the major raw asset, except significant influence on economy, is a key factor in international policy. Practically all financial assets are under its pressure. There are 4 key oil assets trade in the financial market: Brent; WTI; Urals; Light Sweet. As a Forex trade asset, oil is most often provided by quarter futures, so the date of an expiration should be controlled.

The price of oil is influenced by a set of natural and geopolitical factors, each of which needs to be considered for making a decision. Information on the quantity of inventories of oil in the USA and in other large countries is considered the strongest statistics in case of oil trade (except force majeure like military or political conflicts).

If they say that the deposit in a couple of thousands of dollars is enough for oil trade – don't believe. It was long ago when was considered that on oil it is impossible to be lost. Even cents deposits «shook» about three years ago on it. The hour schedule Brent is shown in the scheme below.

Intraday speculative volatility on oil can reach 300 points only on fundamental factors, such as the military conflicts, problems of relations between the OPEC countries, price regulation in political goals and the other information which hardly is giving in to systematization. Mortgage cost on oil assets can be a serious argument too. For normal trade in such conditions, it will be required from $10000 and strong nerves. Those, who after all wants to feel the oil speculator, we recommend looking for mini-options of these assets.

The states are always large participants of stock oil exchange trading, now the oil is the most politized raw asset. As all transactions on the oil contracts are concluded in USD (small amounts under direct contracts in yuan and some other currencies have no leading role), the oil not so a Forex trade asset, as the excellent indicator and the catalyst of the market.

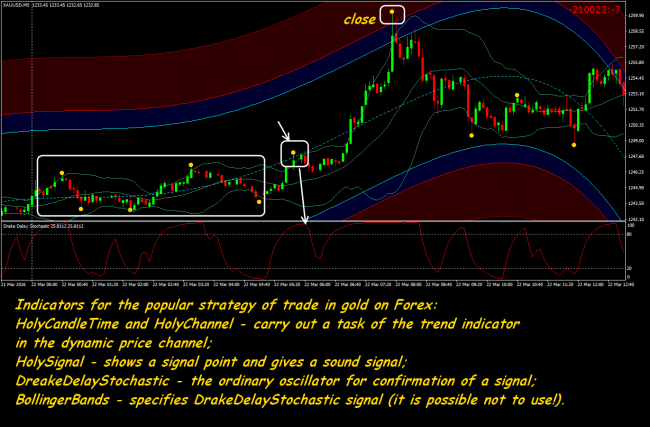

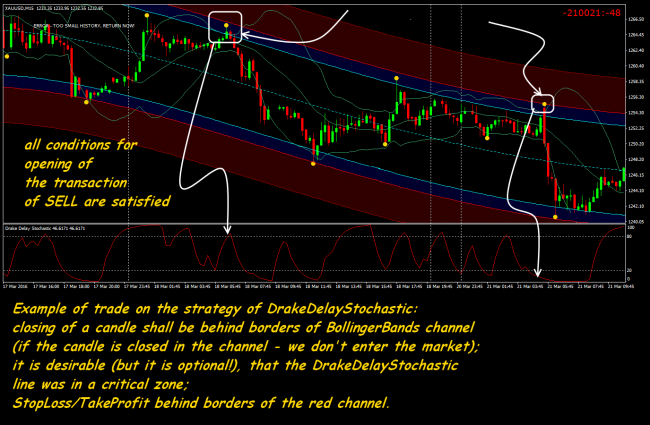

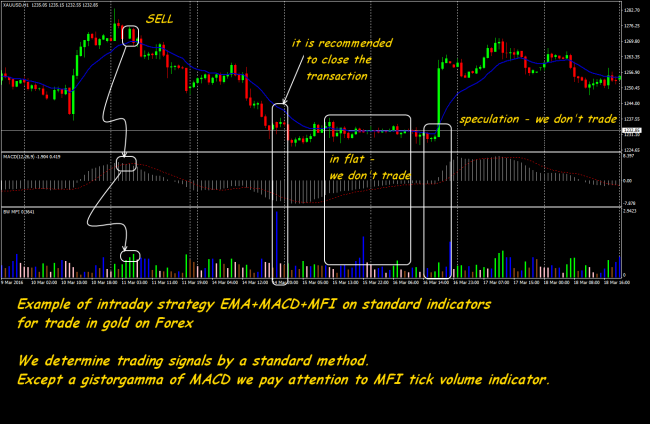

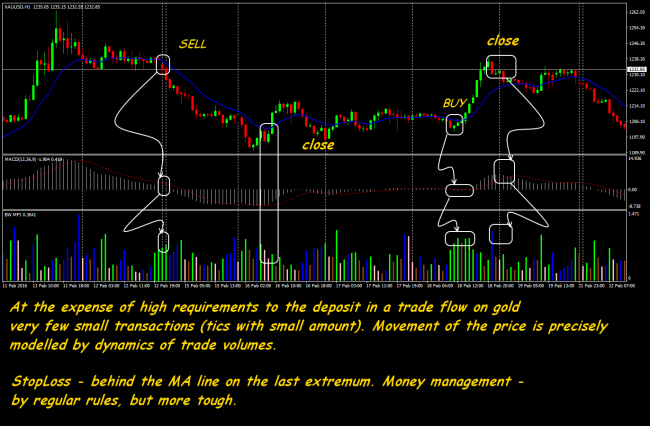

Gold

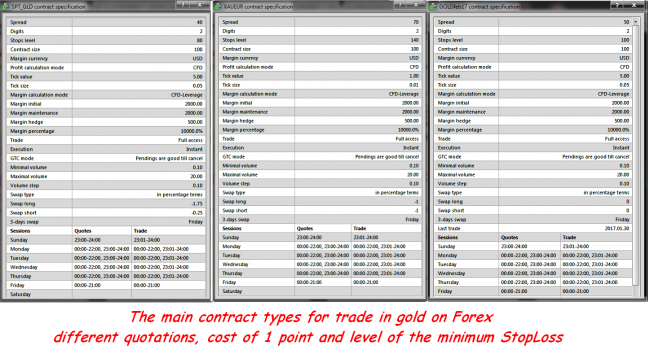

Gold is a historical asset shelter, the price of it became the political tool long ago. In the case of the slightest problems large players, salvaging the equities, take away means from any potentially dangerous transactions and put in gold. Fixing of quotations on gold at 10:30 and 15:00 by London − this period can be used for trade or positioning next day. Among raw assets exactly to gold you may apply rather successfully a technical analysis, and some reckless persons try even automatic trade. Without sufficient knowledge of the fundamental analysis, it is very dangerous to trade gold.

Extremely high volatility and cost of point usually attract beginners, and it is very good that the high cost of the trade lot − even in the case of leverage 1:100 mortgage cost of 1 lot will constitute about $1500 and above − cuts small deposits from similar trade. And what various gurus from Forex didn't speak, the deposit from $10000 and leverage no more than 1:50 is necessary for stable trade in gold. Of course, if you want to earn for yourself, but not to give quicker money to the broker. All Forex assets on gold have rather high spread, and therefore only medium-term transactions can be more or less profitable.

It is considered that all «gold» sports assets have a rather strong correlation with basic assets (EUR/GBP, AUD/USD, USD/JPY), and also strong direct connection with a dollar index and an oil price (on WTI – is stronger, one Brent − weaker). Influence of oil on gold is shown in the form of trading signals only if during the day the market has no other fundamental factors.

The idea popular earlier that the EUR/USD rate advances a gold rate doesn't work now. Gold has long and very strong fundamental connections only with Australian dollar (AUD/USD) therefore RBA constantly rebalance the gold and exchange inventories, and other Central Banks are forced to buy AUD for settlement.

Gold has multiple-factor connections with the stock markets, raw materials, derivatives, policy, and it is difficult to count its reaction to news information. Technically this asset is also not suitable for news trade – there is practically no Forex broker which would provide at such moments market execution without strong slipping.

Silver

If the gold is means of accumulation, then silver, first of all, technological raw materials − about 45% of the amount realized in the market uses by the industry. Demand for this Forex trade asset grows as its natural inventories are promptly reduced. The most liquidity on a spot silver is on the joint Europe-America and America session till 14:00 (New York time). After the American markets closed the liquidity sharply decreases till the opening of Asian stock exchanges which trade results render strong fundamental influence on Forex market on silver.

After the closing of the Asian stock market during the European session large deals on silver are applied only by hedgers to risks insurance. It is also recommended to collect all available information and to track the moments of an expiration of large trade options on silver.

Stock exchange trading on silver and USD/CAD rate (Canada – the large producer of industrial silver) has serious joint influence though the current correlation doesn't reflect it. Silver has traditionally strong correlation with USD/JPY and yen crosses, and through yen (with delay) it influences GBP.

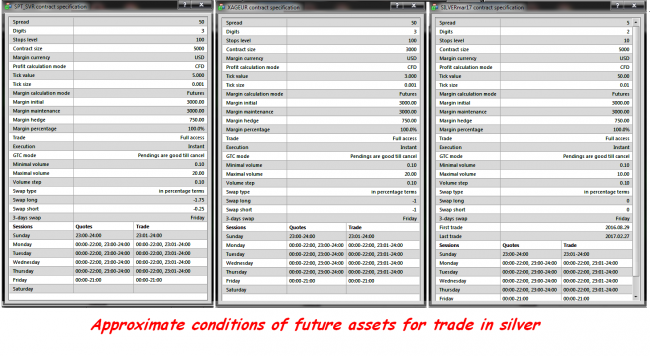

Usually, silver is traded on Forex in the form of the CFD contract or the «net» future. Attentively study trade conditions, especially spread and terms of an expiration. All a spot assets with Silver are characterized by high volatility: annual price fluctuations can reach 60-80%. But this volatility poorly takes to the technical estimation, therefore, trade in silver can give a stable profit at least on a medium-term trade when the influence of fundamental factors amplifies.

The recommended strategy. Now nobody remembers that the well-known strategy Puria Method was created for trade in particular by silver and continues to show on it quite good results. For this asset simple technical strategy on the basis of moving averages, for instance, a linking of SMA(3)-SMA(5)-SMA(8), and also options based on the Alligator+AO, are the most stable. But stops shall be rather «distant» that they weren't got by intraday throws. For those who are able to use Price Action, not to find the best trade asset.

Transactions keep opened from several hours to one week and more, the scalping on this asset is contraindicated. Experiments with silver categorically aren't recommended to beginners who are attracted by the high cost of point (to $50). To hold the deposit on speculative volatility, we open positions b the reduced lots. Stable trade is possible only on deposits from $10000 and by serious fundamental preparation.

Forex index trade assets

These tools are brought most close to the exchange trade and intended for fans to rummage in the economy more deeply. Practically all are traded in the form of CFD or futures. Assets are characterized by high volatility at the low cost of a point and small spread. The dollar index is considered the most technical, the others strongly depend on the corporate, industry, state and another base, SP500 is stronger than all. The traders who understood dynamics of the corresponding indexes have effective additional indicators for trade in basic assets.

And as the conclusion …

It`s understood that beginners should choose already ready trade strategy until they are able to develop they own, and the strategy is simpler, the better. The tested technique shall be clear to the trader technically, it shall contain a minimum of indicators, suit the trader on the time mode and consider the real trade deposit. The task of trade strategy – to help with the understanding of a situation, but not only to issue a trading signal.

All beginners try to trade everything that moves at the moment, but it doesn`t make sense to work at a set of Forex trade assets. You should treat a trade asset as to favorite weapon − to know it, to respect and to use correctly. You should study its reaction to various factors, to adapt to the time schedule of activity, to understand why it moves that way now and what should wait for further.

Social button for Joomla