Quite often you can see a picture of traders arguing about which style of trading is the best, where intraday trading is subject to comprehensive though unfounded criticism. Therefore, to save someone’s nerves, we’ll try to figure out what intraday Forex strategies are like, after which we’ll examine an interesting example on Renko charts.

First of all, let’s destroy the myths, stereotypes and misconceptions of the critics that prevent newcomers from getting a clear picture and collecting all the pieces of the puzzle. So, the misconception No.1 is “Dealing center won’t allow to earn because of the high spreads and commissions”. In fact, it used to be so a decade ago, but there are many companies that allow working in ECN system on the market now, and if you want you can even trade currency futures on the CME, and the greater the turnover, the cheaper the commission will cost.

Misconception No.2: “Lots of noise within the day”. This is generally wrong attitude to the market, because if the quotation exists, it means that someone made a decision and made a deal – how can it be called noise? This is the real action of a real subject, the question is how the trader will interpret the situation – by the way, today we’ll take a look at the method of filtration of “incomprehensible situations”.

And the last misconception is “Daytrading is a very nervous and time-consuming style”. First of all, the nerves arise either as a result of improper trading strategy (the most common), or because the person has unstable psyche. Secondly, don’t confuse pipsing and scalping.

What to consider when choosing intraday Forex strategies

In continuation of the mentioned problem, we should note that it is really reasonable to reject scalping at once. The matter is that only powerful robots can handle it, which have nothing in common with the usual trading desks, and if the speculator decided to pips, they will automatically start to struggle with large funds and banks, without realizing it.

Based on our experience, we can say that the highest and the most stable return is generated by scalpers, not pipsers. At that, for successful trading within the day, you have to abandon the majority of the usual strategies and accept the simple truth that only volatility becomes the determining criterion for decision-making.

This means that the price range and each quotation separately form the basis of a market system of coordinates, i.e., those “bricks” on which all the usual candles and bars are built. We should note that, for example, the Fibonacci levels are nothing more than an attempt to trade volatility, as only the extremes of the price are taken into account, without “looking back” at the time, during which the model was formed.

Fortunately, thanks to the efforts of Steve Nison, since 1990 the Western traders have had an opportunity to create intraday Forex strategies on Renko charts, which will be discussed below. This method of cost performance is characterized by the following strengths:

- All the elements are equal in meaning, which is not true for the usual candles that may differ by tens of points;

- The chart clearly shows the extremes and fractures;

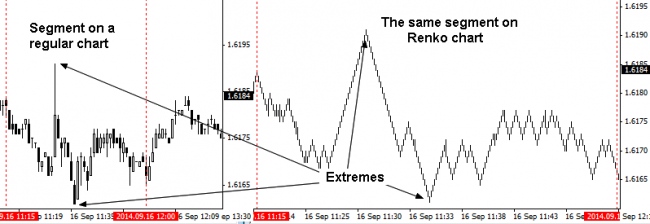

- Due to using the coordinate system “price-bar number” instead of “price-time”, it is possible to evaluate the real picture of the market. The figure below shows a clear example of such a situation:

Going forward, it should be noted that Renko charts get most of the technical indicators back to life, which are late on a regular chart or give out a lot of false alarms, which drew our attention at the time. At that, almost any usual oscillator may be a good entry point generator, and the moving average acquires an additional variant of the construction.

We should note that all the “experts” that prove the futility of scalping always bring losing trades on simple charts as arguments. Perhaps, we can agree with them in this respect, because you have to wait for the candle to close in order to confirm the signals during active trading, which inevitably leads to a late entry and big stop-loss.

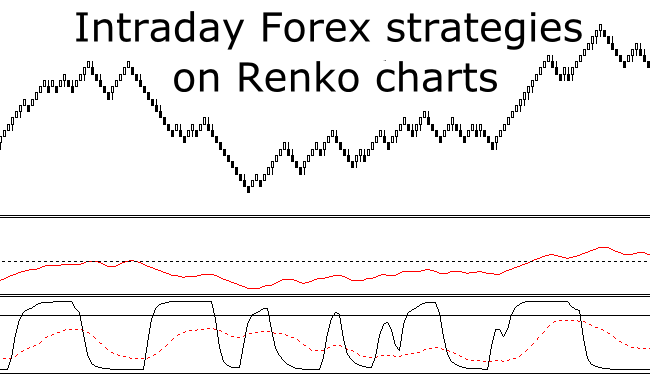

Intraday Forex strategies on the “bricks”

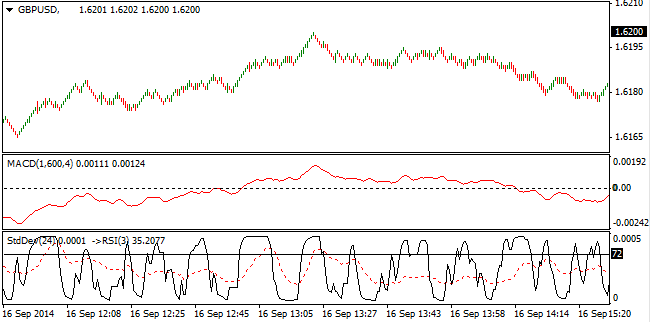

Thus, the most important point is made clear: we trade on Renko and ignore the signals on a regular chart. Now let’s consider the example of a specific strategy, which will require the following indicators: Standard Deviation (on the opening prices), RSI and MACD. Also, to build Renko charts in MT4 terminal, you need to install the free Renko Live Chart EA and adjust it according to the instructions from the authors. The figure below shows the pattern of the said system on the chart, where each “brick” is equal to one point:

MACD in this case plays its usual role, i.e. defines the trend. Here we remind that you shouldn’t try to look for a divergence – this is a dead-end path. Standard Deviation is a central element to the strategy that is even more important that the trend, as it allows to determine the moment when the market begins to return to normal after a significant deviation.

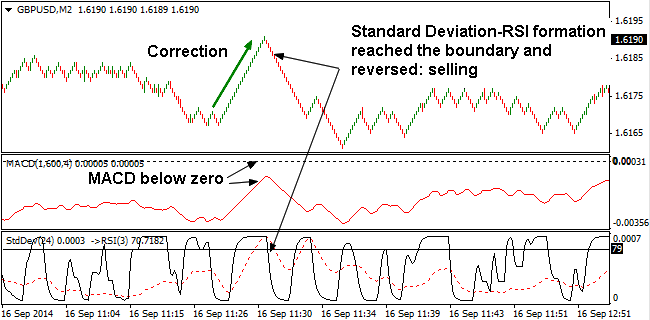

In fact, this is the entry signal, i.e. deal in the direction of the trend is made after the Standard Deviation value starts to decrease. For a more visual presentation and additional filtering of random fluctuations, the relative strength index (RSI) is calculated based on the values of the standard deviation, which acts as a signal indicator. Typical signal to sell is considered below:

Thus, several conditions must be met to sell. First of all, MACD values are below zero, secondly, the price is increasing for some period of time, i.e. the correction is formed, and thirdly, the relative strength index of the standard deviation reached a set boundary (in this case, level 79) and changed its direction to the downward, indicating that the correction is over.

For signals to buy, the conditions are diametrically opposed, with the exception of the situation in the formation of “Standard Deviation > RSI”, which must also reach the limiting boundaries. This is due to the nature of the standard deviation that cannot be negative.

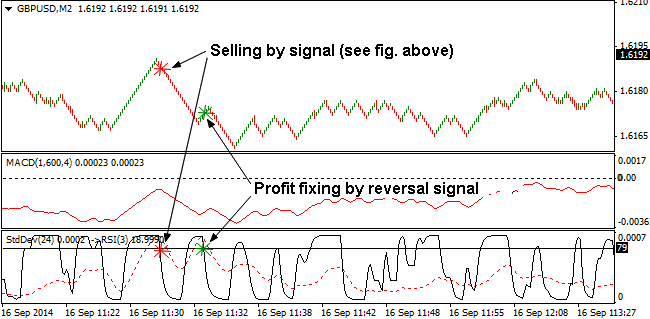

Such intraday Forex strategies allow to support and close a position in two ways. The first is a stop-loss and take-profit. It is impractical to recommend specific parameters in this case, because each currency pair has its own volatility, so let everyone independently optimize the model under their own trading instrument.

The second support option is to close a deal on a reversal signal, i.e. when the deviation reappears, but when moving in the opposite direction. At the same time, it is acceptable to average even by a new signal if the correction continued. Of course, the losing trades will not be avoided, but they will at least be objective, rather than the result of stop failure after the next important news. We should also note that the latest option is ideal for volatile commodity currencies. Source: Dewinforex

Social button for Joomla