This article will review a strategy which made its mark in traders’ wide circles. Forex Smart strategy is a powerful tool for a trader of any level, and allows receiving high profit, which is largely due to trading in 4-hour timeframe. Clever strategy is based on the time-tested indicators and is simple enough to learn, thus immediately attracting a lot of attention of both experienced and beginning traders.

As you've probably understood, trading will be carried out in 4H timeframe. By choosing four-hour interval, we kill two birds with one stone: we get a smaller market noise (volatility) and increase potential profit. There are no restrictions on currency pairs, but as it happens in most cases, the strategy behaves well on EUR/USD, universal appeal and popular pair.

Forex Smart strategy consists of basic indicators:

1) Linear weighted moving average (LWMA) with the following settings: period of 8, zero offset, applied to the average price. It will be shown blue on the chart.

2) Another moving average of the same type, but with a period of 21. The rest values are similar to the previous one. The chosen color is orange.

3) Parabolic SAR indicator. Settings: step of 0.0026, the allowable maximum is 0.5.

4) The next in the inventory we have a popular Stochastic Oscillator. Settings: slowdown of 5, K period of 12, D period of 12. The indicator will be based on the closing prices. It is important to note that the trader must choose MA of exponential type. For convenience, we’ll add extra levels of 40 and 60.

5) The final instrument for trading under Forex Smart strategy would be MACD indicator. The settings are custom again: fast EMA is 8, slow EMA is 21, MACD SMA is 1, and select “Weighted Close” in the field “Apply to”.

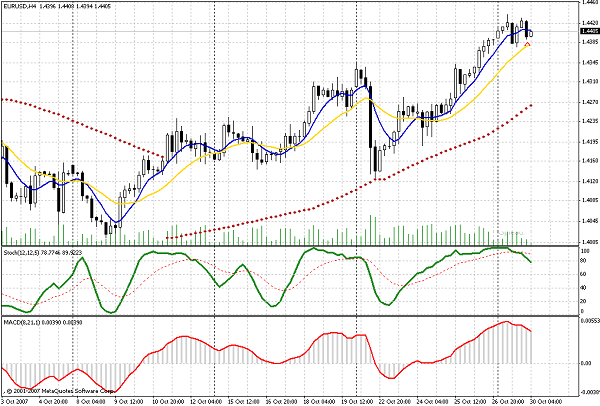

Once you have successfully added all the indicators and made the necessary add-ons, you will see the following on the trading terminal screen:

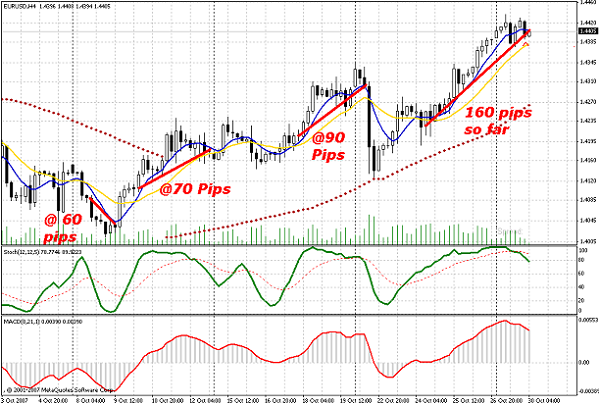

Now it's time to go directly to trading and trade opening rules. Forex Smart strategy assumes that the main call to action is when the fast moving average (blue) crosses the slow moving average (orange). Only the intercrossing of these lines leads us to the following actions:

We analyze the state of the Parabolic SAR indicator. If its chart is below the current price, we forget about sell deals – it’s time to buy! There are cases when Parabolic SAR is on the other side after averages’ intercrossing, but after that it still goes to expected place (by supporting the upward crossing). In this case, we can look for points to open buy orders, but only if Parabolic changed within 20 hours (5 candlestick bars).

In case if the Parabolic indicator’s lines are on the top, over the price, we only consider the options to sell. To avoid confusion, it is recommended to use the MACD indicator. The trader should wait until the MACD confirms the crossing of moving averages. This strategy is not designed for short-term deals, it is positioned more as a medium one.

To finally minimize the risks, you should monitor the Stochastic indicator. Is the indicator showing overbought condition of the market? Deals to buy are risky, it’s better wait for the next signal. Conversely, if the market is oversold, we won’t sell.

So, we are done with the entry points and actions, the only question that remained unsolved is how to quit position under Forex Smart strategy.

Orders are closed by a clear algorithm. The trader monitors the Stochastic indicator, and if the order to buy is opened and the value of the indicator drops from 80 to 60 and crosses 60 mark, then it’s a signal to close the position.

When we are on the bears’ side and are selling, we need to wait until the indicator grows from 20 mark to 40, and then close the position.

Finally, the third signal to quit the position is crossing of moving averages. They don’t only point to the moments of deals opening, but in the case of already open positions also indicate the reverse signal – to close. This signal is rarely used in practice, since the Stochastic usually gives signals much earlier.

Deal opening and closing under Forex Smart strategy:

Source: Dewinforex

Source: Dewinforex