This trading robot will suit lovers of calm and clear trading, the transactions principle can be described in one phrase “buy at high census, sell at the breakdown of the low”. Of course, filters of the breakdown genuineness were introduced to the algorithm of the EA for its stability.

This trading robot will suit lovers of calm and clear trading, the transactions principle can be described in one phrase “buy at high census, sell at the breakdown of the low”. Of course, filters of the breakdown genuineness were introduced to the algorithm of the EA for its stability.

The Wallbreaker expert advisor can be called a breakdown trading robot: after the breakdown of the important resistance level, it begins to monitor the price behavior and makes a deal after the correction. At that, trading can be conducted on any timeframe from m1 to h4 – of course, on the older time intervals the transactions are much less common, but the influence of the "noise" is less as well.

The EA algorithm allows to analyze the type of resistance breakdown. Preference is given to sudden, impulsive price movements, if the price broke the important level with difficulty, and the volatility in this case was low, such a breakdown is ignored.

Among the distinctive features of the MTS, we can distinguish an interesting system of setting SL and TP. Overall, block of the MM settings in this EA is very flexible and allows to customize the system as you like in each case.

Wallbreaker expert advisor: getting started

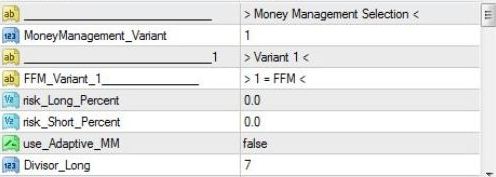

All settings of the EA can be divided into 2 blocks: block of capital management settings and the so-called time management settings. There are 3 modes of MM in total ¬– 2 variants of the dynamic lot and the ability to trade with a fixed lot.

1. Fixed Fractional MM (value 1 in MoneyManagement_Variant string) – the amount of the transaction is calculated based on the size of the deposit (with profit taken into account). Basic settings:

- Risk_long/short_Percent – acceptable risk in the deal to buy/sell is indicated as a percentage;

- Use_Adaptive_MM – enabling this option will make the EA calculate acceptable risk in the deal on the basis of accumulated profits;

- Divisor_Long/Divisor_Short – divisor.

If the deposit amount is $15,000 ($10,000 + $5,000 profit), and the risk is set at 2%, the lot size will be calculated on the basis of risk 0.02·$15,000 = $300. When the divider is 7, the tolerable risk is $5,000/7 = $714.29, which means the expert advisor will take this risk into account when calculating the size of the position.

2. ReInvest Money-Management (MoneyManagement_Variant - 2), the risk of the transaction is calculated as a fixed amount + percentage from profit/loss. Includes options such as:

- BasicRisk_L/BasicRisk_S – the fixed part of the risk for long/short positions;

- Reinvest_PcL/Reinvest_PcS – frequency of profit/loss as a percentage to buy/sell;

- MaxRisk_PcL/MaxRisk_PcS – the maximum risk of the transaction to buy/sell.

3. Fixed Lotsize (MoneyManagement_Variant - 3), the trading is conducted with a fixed lot. The parameters allow to customize:

- Lots_Long/Short – lot size to buy/sell;

- Auto_Trade_Open – at activation, the EA will not ask for confirmation for the position opening;

- doTheTradeManagement – allows to disable the automatic setting of SL and TP;

- SL_AT_Trade_Open_Long/Short and TP_AT_Trade_Open_Long/Short – SL and TP levels to buy/sell respectively.

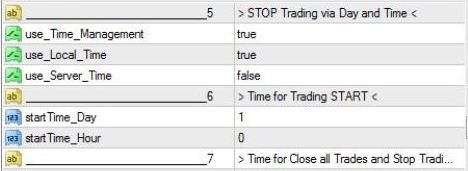

Implementation of time management

Everyone knows that the volatility significantly differs depending on the time of day, and the Wallbreaker expert advisor takes this fact into account. The use_Time_Management parameter is responsible for enabling the time management. Among other settings of the robot, the following can be identified:

- use_Local_Time/use_Server_Time – allows you to use either the local time (of the time zone where the trader is), or the time of the broker. At a large difference in time zones, it is better to use the time of the broker;

- startTime_Day, startTime_Hour – allows you to specify the day and hour of the start of trading. Days are indicated by numbers, Sunday is 0 and Saturday is 6;

- endTime_Day, endTime_Hour, endTime_Minute – time of the trading end (day, hour, minute);

- Slippage – permissible slippage;

- MaxSpread – permissible spread value. It is an especially important parameter if the DC has a floating spread.

With regard to the maximum risk, when trading with one pair, it is undesirable that the risk of the transaction exceeds 5% of the deposit. When trading on the EUR/USD and GBP/USD at the same time, the total risk on open positions should not exceed 7-10%.

Testing of the expert advisor

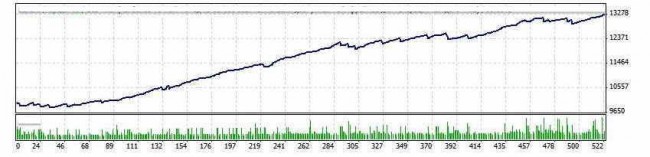

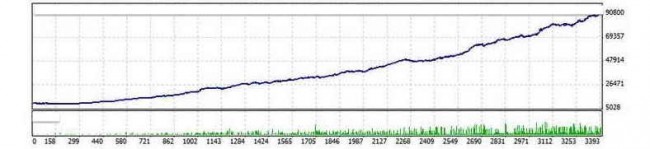

The EA concludes relatively few transactions, so m15 timeframe was selected for testing. Testing was conducted during the period from 2013 on the original pairs for the EA: GBP/USD and EUR/USD.

Testing on GBP/USD was quite successful, but for nearly 6 years of testing the Wallbreaker expert advisor concluded only 521 deals – this is a low figure for m15 timeframe. Drawdown is small (under 3%) and the deposit growth curve says about relatively constant capital gains. The only note is that after 2010, the result was slightly worse.

Testing on EUR/USD is characterized primarily with the intensity of trading: during the same time period in the same timeframe, the EA concluded 3,389 transactions. The profit differs respectively: if the pound managed to earn $3,250.37, the EUR/USD – $80,548.23.

Overall impression is that the EA was originally created for EUR/USD, and the ability to trade on the pound was added later and optimization in this case is lame: too much of a difference in the results.

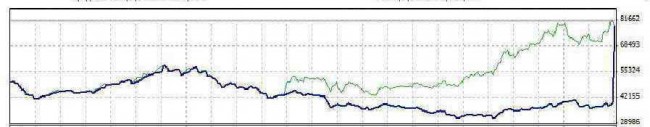

In 2014, the situation has somewhat changed – when testing from the beginning of this year to November 5, the EA could not operate profitably, the deterioration occurred both on GBP/USD and EUR/USD. Obviously, the defaults need to be optimized.

Summing-up

The Wallbreaker expert advisor certainly deserves attention: first of all, due to the fact that it is based on simple pattern – after the breakdown of the resistance, the price is likely to continue moving in the direction of the breakdown. The author's approach to capital management is also very interesting.

Profitability of the EA is not in doubt until 2014. This year, the test results with standard settings leave much to be desired. Profit was small on euro, and the GBP/USD pair even saw loss at the end of the test. Balance change curve says that the default settings are already outdated.

Overall, the Wallbreaker expert advisor can be recommended for trading on a live account, but only after further optimization. I t is better to pay attention to the EUR/USD pair, as the intensity of trading, and hence profits, are times less on the pound.

Social button for Joomla