This EA is designed for trading on small time intervals (no more than h1), only the readings of indicators are taken into account at making deals. So, the FX Lightning expert advisor can be called a classic scalping trading robot.

The author claims that by using this MTS, you can automate trading on EUR/USD, USD/CHF, USD/CAD, NZD/USD, AUD/JPY, EUR/JPY, GBP/USD currency pairs. In addition to multi-currency, very low demands to the size of the deposit should also be noted – you can trade having at least $100 at the account.

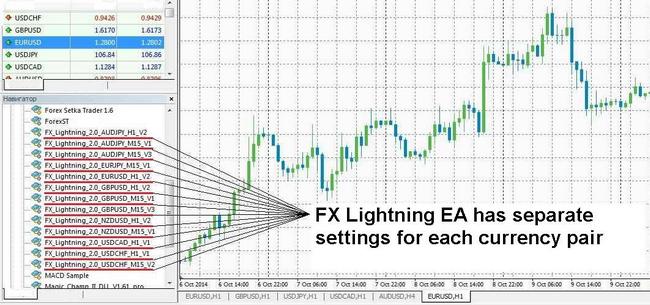

The expert advisor is freely available, but it is important not to make a mistake when choosing the right file. There are 14 files with .ex4 extension in the archive – 2 for each currency pair. You can also try using different sets for the same currency pair.

As for the money management rules, the trading robot gives the opportunity to both trade with a fixed lot and use a simple money management. With dynamic lot, its size will depend on the equity.

How to prepare FX Lightning expert advisor to work

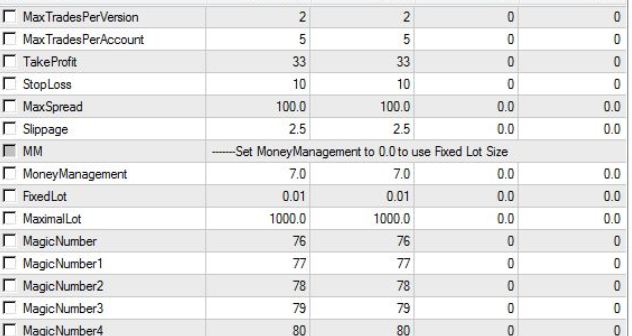

As for the settings that affect the assessment of situation by the advisor, they can not be modified – they are built into the code of the trading robot. A trader can change settings such as:

- MaxTradesPerVersion – this parameter determines the maximum number of positions on the same currency pair;

- MaxTradesPerAccount – the same, but the number of positions on all currency pairs is taken into account;

- MaxSpread – the maximum permissible value of the spread, trading stops above this parameter;

- Slippage – permissible slippage;

- MoneyManagement – to disable trading with a dynamic lot, this parameter must be set to 0;

- FixedLot – the value of the fixed lot;

- MaximalLot – limit value of the lot for trading, can be set only at the enabled MM;

- Magic Number – different Magic Numbers are used to prevent the advisor from confusing the orders at simultaneously trading on several currency pairs.

Maxspread must be noted among these parameters, because the value of spread highly affects trading results. The author argues that the reduction of the spread makes trading more relaxed and reduces the number of losing trades. Those who like combining manual and automated trading should be aware that the FX Lightning expert advisor does not take into account the orders opened manually.

Testing of the expert advisor on GBP/USD and EUR/USD pairs

All possible settings were used for testing, the test was performed on both the m15 and the h1 timeframes. Since the author positions the trading robot as a very stable, testing was performed on a time interval of 6 years.

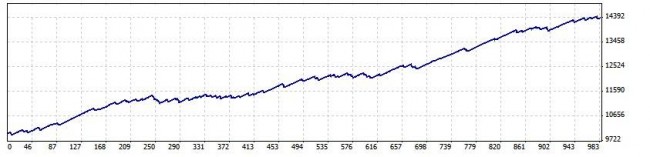

The expert advisor closed a 3-year period with a profit on the most popular pairs. In terms of profitability, the best result was shown by the EUR/USD currency pair. By the end of testing, profit was $4,380.60 at the initial deposit of $10,000.

The expert advisor was indeed quite stable, its drawdown didn’t exceed 3.17%, while the expected payoff was 4.46, and the profitability – 1.89. No sharp drawdowns were on the balance curve, the deposit grew steadily throughout the testing. The disadvantage is the small size of profit, but the safest option trading (with a fixed lot) was used in testing.

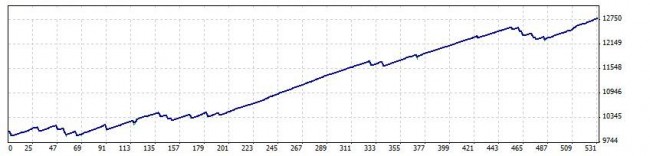

Testing on another popular GBP/USD pair showed somewhat worse result. Deterioration mainly affected profitability – profit for the nearly 6-year testing period was only $2,778.84. The FX Lightning expert advisor made only 530 transactions, which is not the best result for trading on the m15.

The test results for other currency pairs

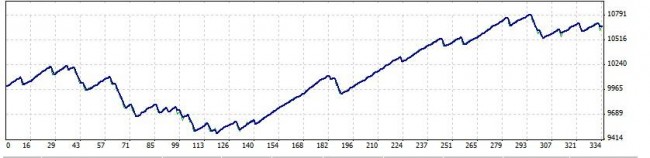

Outsider was EUR/JPY, the profit was only $673.94 for the same time when testing on m15 timeframe. The drawdown slightly increased (to 8.08%), but the main disadvantage is instability of trading. The chart of the deposit growth shows that approximately 40% of the time the expert advisor traded at a small loss, and only then a series of profitable trades followed. This pair cannot be recommended for trading.

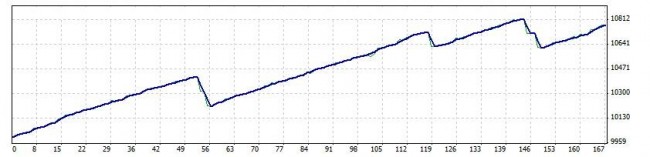

The rest of the currency pairs show intermediate picture. For example, NZD/USD ensures profitable and stable trading, but the amount of profit ($777.26) hardly speaks in its favor. In addition, during the test only 167 transactions were concluded. That is, about 25-30 transactions were made on h1 timeframe per year.

As for the other currency pairs, their results can be called average: on the one hand, stability of trading is ensured and the deposit is not threatened with siphon off, on the other hand, the profit margin does not allow to talk seriously about the use of the expert advisor in real trading. If profit over 6 years is about 15-20%, it is much more profitable to just put money in the bank.

Summarizing

The FX Lightning expert advisor leaves mixed feelings. It can be safely said that on most currency pairs it provides stable results for several years (at least on the test results). The price paid for this versatility is a significant decline in profitability, which prevents the use of the EA in real trading.

As for multi-currency, the expert advisor generally trades profitably on all the currency pairs listed by the author. However, stability of trading is poor on some of them. EUR/JPY especially stood out in this regard.

The disadvantages of the expert advisor include dependence from the spread, and the inability on the part of the trader to affect the algorithm of the expert advisor. This limits the ability to optimize the trading robot. In addition, the mechanism of making deals in unknown.

And yet the expert advisor has the potential, not every robot will be able to show profit by trading without optimization for almost 6 years. Perhaps, more specialization, i.e. more careful selection of the parameters for a particular currency pair could have remedied the situation with a low profit. But this is not possible, as a trader can change nothing except money management, changes in the allowable spread and slippage.

Social button for Joomla