At a certain stage of their professional growth, traders start studying complex algorithms, but many do not take into account the fact that not every complex system can bring an expected revenue – on the contrary, the more methods are employed in work, the more the efficiency of each of them decreases.

Forex Shocker EA is built precisely on such a complex system. Among other things, the commercials note that it is based on neural networks and is a unique algorithm, which is, of course, an exaggeration. Neural network programming involves the initial training of the system, which is then engaged in self-education, while this EA doesn’t adapt to the market on its own: all it can do independently is to set a lot, depending on the account balance. But first things first.

Studying the operating methods built into the Forex Shocker EA

First of all, let’s review the algorithms the robot contains – each of them opens deals with its unique magic number. The following indicators are used for direct signal generation:

- fractals;

- RSI with various periods;

- CCI with several period and signal lines;

- Momentum;

- Williams Percent Range;

- A number of versions and modifications also employ Bollinger Bands and Moving Averages.

Nothing beyond the standard application of these indicators was detected, and the main difficulty lies in the accurate customization of money management to make it combine an original set of methods on one account. To do so, the authors offer a MoneyManagement parameter, which at a «true» value will allow you opening deals valued at 0.1 lot per free 1,000 of account currency. You should pay attention to the problems arising as a result of such adjustment – namely, the robot can first open correct orders for one group of signals, but the next opens with a smaller lot, because the available balance has decreased due to the deposit for already opened deals, though the quality of subsequent signals aren’t worse than those in the beginning.

The authors do not recommend turning this option on without optimization: it is better to use your own settings, and be especially careful with the Aggressive, Very Aggressive and SuperAggressive settings. We recommend turning them off neither by a professional nor a beginner: the former will lose time, the latter – money.

Next comes a block of time settings – here everything is very simple and is detailed in the authors’ manual, so we won’t focus on it. Now we should pay attention to the magic numbers: their setting is done to ensure that each group of signals has its unique number. In order to avoid confusion and errors, it starts from 101 for the first group by default, and if other EAs don’t work on this same account and duplicate numbers, it is not recommended to change them.

Testing and optimizing the Forex Shocker EA

Experienced users know that almost any robot can be adjusted to the history to make it show impressive results in the strategy tester – the only question is the time spent on parameters search. And, of course, the algorithm under consideration is not an exception, with one of the optimization results being presented in the figure below:

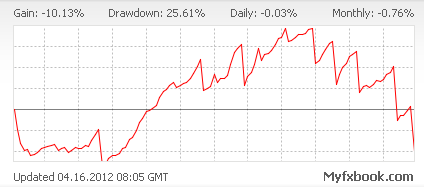

It would seem that the Grail is found, but the real accounts using the Forex Shocker EA were "monitored" at the time and found out a number of obvious deficiencies in the work. For example, the test for one account was suspended as soon as the robot started to siphon the deposit:

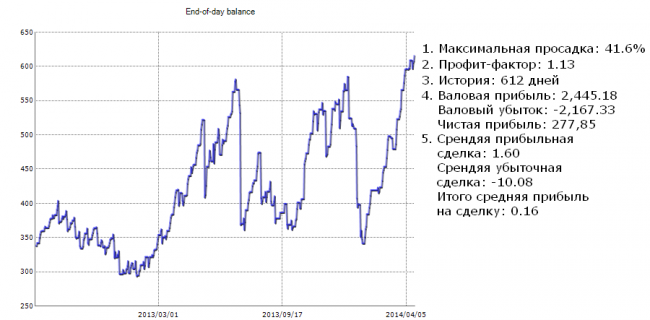

Another real account created by the developers specifically for testing on recommended settings is still alive, and that's what we take a closer look at. Below you can see the dynamics of the deposit, as well as the main indicators characterizing the EA efficiency:

Let’s comment on the results received:

- The maximum drawdown of nearly 42% turns the potential EA into a siphon;

- Net income of $278 (or 82.25 % of the deposit) for 612 days is the acceptable profit, other things being equal;

- Profit factor and values of gross profit or loss are not satisfactory in our estimation;

- The most informative indicator, which clarifies the interpretation of the previous one, is the average profit of profitable deal, and it is 6.3 times less than the average stop-loss. Such a ratio is not suitable for stable operation, because a series of stops, in result of increased volatility, will sooner or later destroy the deposit.

Talking about the latter point, it should be noted that the Forex Shocker EA is intended to filter traffic on the news, as it has a relevant block in the settings, but it does not always work correctly, since it cannot upload hourly information from the calendar, and therefore focuses on the ranges instead.

Social button for Joomla