Friday's trading session ended on a minor for a dollar note. Quiet start of the last trading day of last week, did not presage such a rapid closure. In the U.S. session quotes euro and the pound rushed to their local maxima. If released last week showed the Euro zone economy were within expectations,macroeconomic indicators of the British economy slightly pleased investors. Therefore, the pair EUR/USD hit 1.3410 and quotes GBP/USD close to 1.56 .

The situation with the major currency pairs is the same. To the key FED meeting in September, the probability that the market might try to go beyond the medium-term channel is very low. Hurry up with the occupation of positions in such circumstances, it's not necessary, and would be preferable to wait for a signal about the future direction of the movement of the market itself.

Quotes EUR/USD is currently at 1.3380 which corresponds to Friday's close. Given the fact that coming out this week, the news is not so significant, and not be able to move the markets, we can assume that the euro will remain in the corridor 1.3280 - 1.34 .

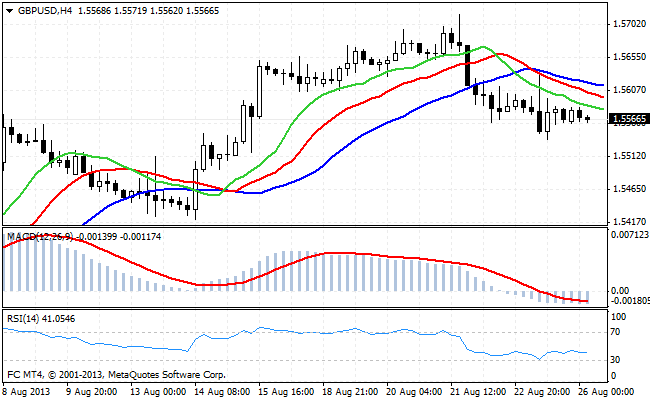

The situation in the GBP/USD pair is similar to the situation in the euro. Reaching the mid-term high of 1.57 pounds quotes are in phase correction movement. In the current situation, going beyond the range of 1.54 - 1.57 also seems unlikely.

From the news, which can slightly affect the activity of the pair EUR/USD, can be identified only publish data IFO, dedicated to the study of business confidence, as well as the CPI.

Thus, the markets are almost literally freeze in anticipation of the fall. Demanding change hearts foreign exchange market participants.

Good luck trading!